HIGHLIGHTS

ASSETS

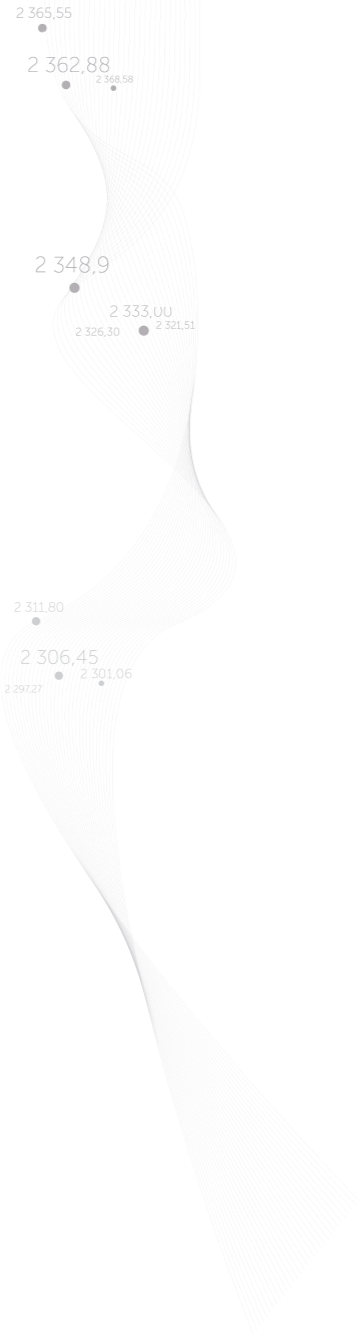

Fig. 22. Dynamics of assets over 5 years, KZT bn

As at December 31, 2019, the Exchange's assets2 amounted to KZT71,041.1 mln, an increase of 37.7% (KZT19,457.3 mln) compared to the last year indicator.

Significant growth of assets is due to the expansion of the Exchange's activities as a Central Counterparty from 2018 on the foreign exchange market and from December 3, 2019 on a number of securities on the stock market. At the end of the year, assets of KASE as a Central Counterparty in the foreign exchange market amounted to KZT961.9 mln, on the stock market (on reverse repo transactions) amounted to KZT25,321.7 mln.

The money and their equivalents amounted to KZT20,261.9 mln, the financial assets recorded at amortized cost amounted to KZT18,770.5 mln and were mainly formed by guarantee contributions and margin collateral of clearing members.

EQUITY AND LIABILITIES

The amount of the Exchange's liabilities increased by KZT16,969.1 mln to KZT59,641.0 mln, of which 55.1% (KZT32,857.0 mln) are funds of clearing members (guarantee contributions and margin collateral), 42.5% (KZT25,321.7 mln) are the liabilities of the Central Counterparty on repo transactions on the stock market and 1.6% (KZT961.9 mln) are the liabilities of the Central Counterparty on the foreign exchange market. Shareholders’ equity of the Exchange for the reporting year increased by 27.9% (KZT2,488.2 mln) to KZT11,400.1 mlnon account of net income recorded in retained earnings item. The share of shareholders’ equity in the structure of liabilities was 16.0%.

Собственный капитал Биржи за отчетный год увеличился на 27,9 % (2 488,2 млн тенге) до 11 400,1 млн тенге за счет полученного чистого дохода, отраженного в статье нераспределенной прибыли. Доля собственного капитала в структуре пассивов составила 16,0 %.

The share capital of the Exchange increased by 12.5% (KZT295.5 mln) and as at December 31, 2019 amounted to KZT2,661.8 mln as a result of the sale of KASE shares to the Moscow Exchange as part of the implementation of the Strategic Cooperation Agreement.

Clearing reserve funds remained at the level of 2018 and amounted to KZT1,750 mln.

Revaluation reserve for fixed assets decreased due to amortization of the revaluation amount by KZT0.4 mln and amounted to KZT179.5 mln.

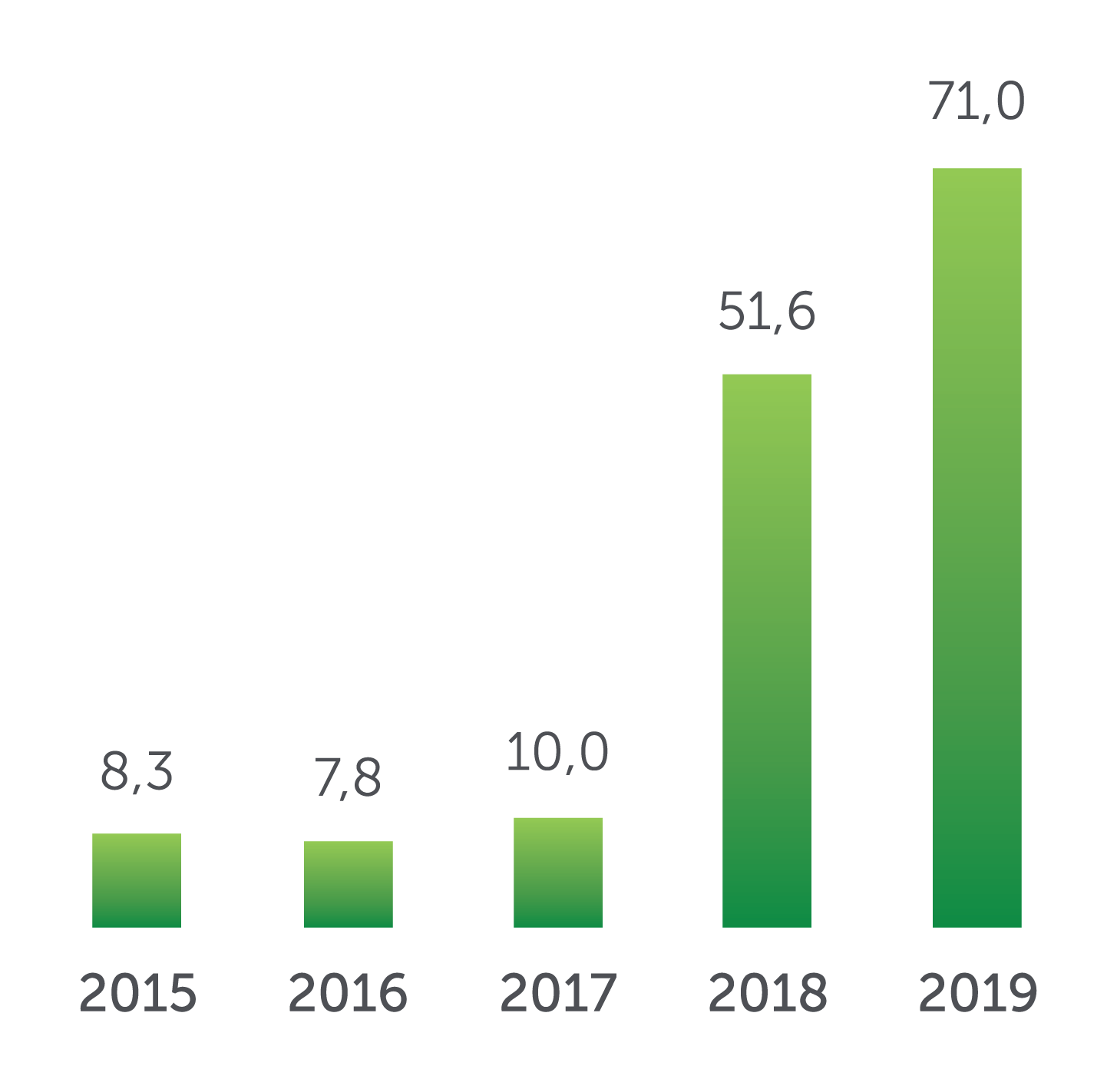

Fig. 23. Key profitability performance indicators

REVENUES

The Exchange’s revenues amounted to KZT4,284.5 mln according to the 2019 results, which is by KZT1,203.6 mln or 39.1% higher than the last year results. Income from services and commission fees amounted to KZT2,474.9 mln having increased by KZT114.1 mln or 4.8%. Interest income increased by KZT1,035.3 mln or 154.1% to KZT1,706.9 mln, including income from investments of margin contributions and money, which are part of the guarantee or reserve funds of the Exchange and other collateral of clearing members amounted to KZT958.7 mln. The increase in interest income was due to an increase in the amount of invested funds.

The Exchange's interest income shows the income associated with the receipt of interest on reverse repo transactions within the framework of the Exchange's functions as a Central Counterparty on the stock market for the amount of KZT31.3 mln. Income from commission fees (41.0%), listing fees (29.4%) and membership fees (10.5%) represent the largest shares of the Exchange’s revenue structure.

Income from membership fees decreased by KZT81.4 mln or 23.9% compared to 2018 and amounted to KZT259.1 mln, which is related to the merger of banks in 2018-2019 and subsequent decrease in the number of the Exchange members under "foreign exchange" and "stock exchange" categories.

The Exchange’s listing fees in 2019 increased by KZT8.9 mln or 1.2% and reached KZT727.1 mln. This growth is due to the increase in the volume of securities issues and the Exchange’s capitalization growth.

The Exchange’s commission fees amounted to KZT1,013.8 mln having increased by KZT20.1 mln or 2.0%. This growth is associated with the stepping up of transactions with the GS and CS, the entry into the IFI borrowing market.

Clearing fees of the Exchange increased by KZT166.2 mln or more than 3.2 times and amounted to KZT239.6 mln due to the exercise of the Exchange's function as a Central Counterparty and the emergence of clearing fees in the foreign exchange market at the end of 2018.

Revenue from information services diminished by KZT0.9 mln or 0.5% in 2019 and came to KZT202.9 mln. This decrease is related to the reduced number of recipients of stock market data.

Fig. 24. Revenue structure by main types of services

EXPENSES

The Exchange's expenses for the year amounted to KZT1,870.0 mln and decreased by KZT68.6 mln or 3.5% compared to the previous year. This decrease is mainly due to lower staff costs, marketing costs and related taxes.

The Exchange's expenses show the expenses associated with the payment of interest on repo transactions within the framework of the Exchange's functions as a Central Counterparty on the stock market for the amount of KZT31.3 mln.

The greatest share of the Exchange cost structure is represented by staff expenses (63.2%) and depreciation and amortization (6.7%).

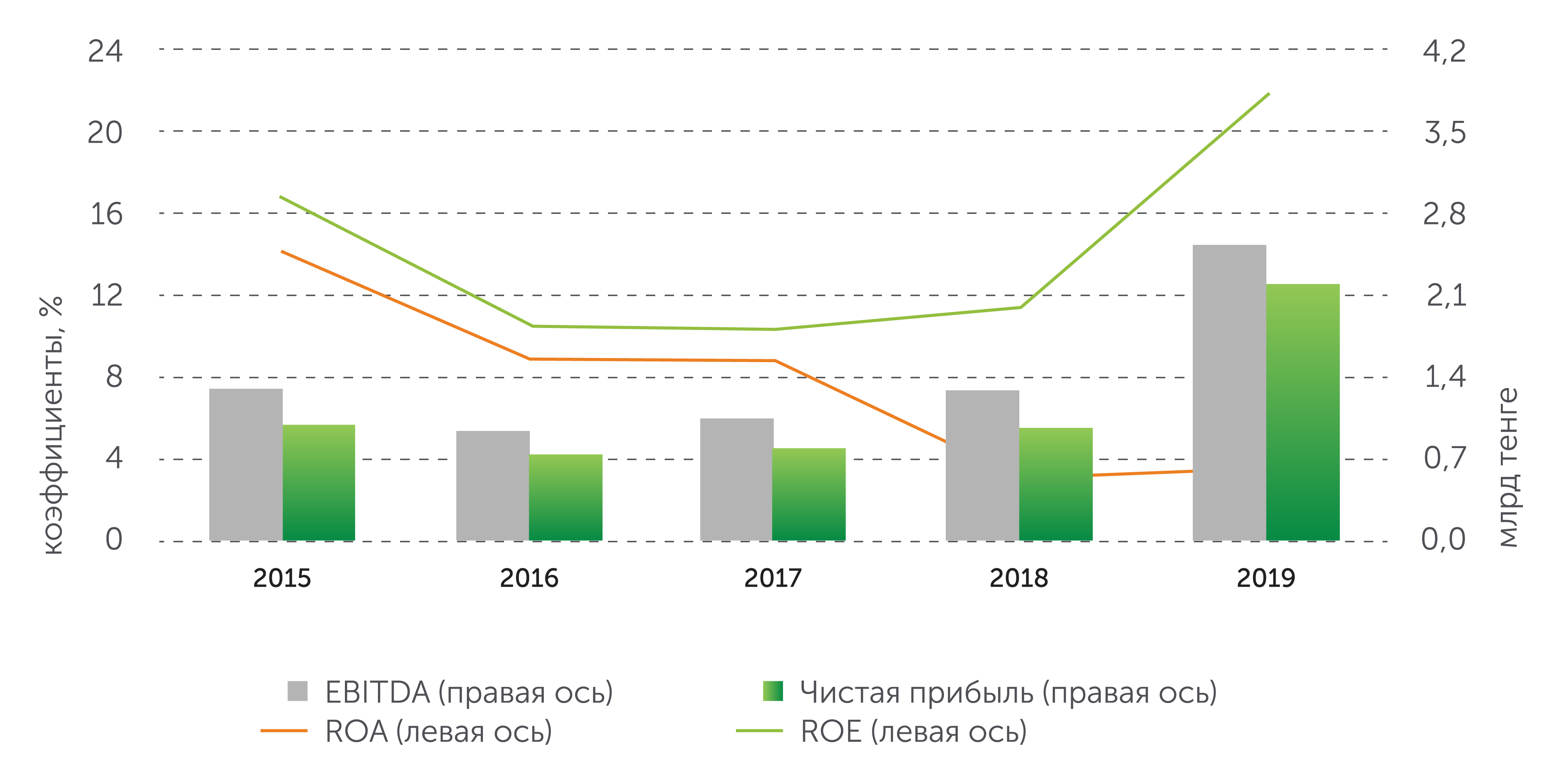

THE EXCHANGE’S OPERATING RESULTS

The Exchange’s net profit for 2019 amounted to KZT2,192.7 mln, which is by 127.1% higher than the last year results. EBITDA increased by 99.2% and made KZT2,539.0 mln. The Exchange’s operating income increased by 39.1% while operating expenses increased by 3.5%, operating profit margin3 increased to 56.4% in 2019 against 37.1% a year earlier. Net profit margin4 increased to 51.2% in 2019 compared to 31.3% a year earlier. The return on equity (ROE) increased from 11.4% to 21.6% according to the 2019 results. The return on assets (ROA) increased from 3.1% to 3.6% as a result of significant increase in net profit.

Fig.25. Key operating performance indicators

form

Try later...