CONTENTS / STRATEGY IMPLEMENTATION REPORT / STRATEGIC DIRECTION 3. INCREASING LIQUIDITY AND EXCHANGE MARKET DEPTH

STRATEGIC DIRECTION 3.

INCREASING LIQUIDITY

AND EXCHANGE MARKET DEPTH

NEW PRODUCTS AND SERVICES

In 2019, trading in new financial instruments was launched on the Exchange's foreign exchange market – long currency swaps with maturities of one week, one month, three months, six months and one year.

In order to extend the trading day as part of the expansion of the possibility of settlements in the Kazakh tenge for foreign and international participants, the continuous session was launched on the foreign exchange market from July 1, 2019, as a result of which the trading day was extended: the end time of foreign exchange trading was changed from 3:30 pm to 5:00 pm, Nur-Sultan time.

- - if the price of the proposed transaction deviates from the last price by 1.5% or more;

- - if the proposed transaction deviates from the cut-off price fixed at the last Frankfurt auction of the current trading day by 1.5 % or more.

The maximum duration of the auction is set by said regulations and lasts 7 minutes. The Frankfurt auction mechanism allows determining the cut-off price at which the maximum possible volume of transactions is concluded.

In order to develop the institution of market-makers for government securities, the conditions for announcing and maintaining quotes for government obligations were changed. As a result, a new market maker for these types of securities, represented by Halyk Savings Bank of Kazakhstan, appeared on the stock market.

- - one-day currency swap transactions with the US dollar;

- - one-day repo transactions with the GS basket carried out by the "automatic" method.

In the derivatives market, trades in one-month futures were opened.

With the transition to the new trading and clearing system ASTS+, an additional scheme for announcing and maintaining quotes by market-makers was developed, which provides for incentive measures in the form of payment of remuneration to market-makers.

INTERACTION

WITH MARKET PARTICIPANTS

- Samruk-Kazyna Construction,

- Baiterek Development,

- MetallInvestAtyrau,

- Transtelecom, and three issuers of shares:

- Transtelecom,

- Mining Company Benkala

- and Caspiy Commodity Exchange.

EVENTS

FOR ISSUERS

During 2019, nine meetings in the form of a roundtable were held on issues concerning the use of stock market instruments. With the support of regional local administrations, a number of events were held for entrepreneurs of Kazakhstan's regions on the topic Fundraising opportunities at the Kazakhstan Stock Exchange". A total of seven regions and the cities of Almaty and Nur-Sultan were involved:

- city of Nur-Sultan

- March 5, 18 participants;

- city of Almaty

- March 28, 22 participants;

- Atyrau region

- April 10, 28 participants;

- East Kazakhstan region

- October 22, 25 participants;

- Kostanay region

- October 25, 28 participants;

- Pavlodar region

- November 5, 21 participants;

- Akmola region

- November 15, 20 participants

- West Kazakhstan region

- November 19, 20 participants;

- Mangystau region

- November 26, 21 participants.

These events were attended by executives, financial directors and owners of companies, as well as representatives of the regional branches of the Damu Fund, RCE Atameken and local executive bodies.

At the same time, during 2019, individual events were held with the owners and executives of Kazakhstan's companies, who can be issuers, to provide advice on the use of stock market instruments. Such events were organized during the participation of delegates from other regions in public events in Almaty, and during working trips to the regions, including:

- Aktau

- Aktobe

- Almaty

- Atyrau

- Karaganda

- Kokshetau

- Kostanay

- Nur-Sultan

- Taldykorgan

- Oral

- Oskemen

- Shymkent

- 4 companies;

- 8 companies;

- 23 companies;

- 9 companies;

- 3 companies;

- 2 companies;

- 2 companies;

- 11 companies;

- 3 companies;

- 4 companies;

- 4 companies;

- 6 companies.

In the course of the work to increase interest in the stock market from potential issuers and in order to establish feedback with investors, the Exchange held business breakfasts annually in major cities of Kazakhstan. During 2019, four such events took place:

- September 19 in Shymkent;

- September 26 in Aktobe;

- November 21 in Almaty;

- December 12 in Nur-Sultan.

TRAINING PROGRAMS

On February 26, the Exchange's employees, together with the Damu Fund and RCE Atameken, held a seminar called "Stock market undamentals" for owners and management of companies, employees of development institutions and local executive bodies.

On March 19, a seminar on the basics of investor relations called "Investor Relations: effective communications with investors" was organized and conducted on the Exchange.

On June 28, together with the company Uchet. kz LLP, an online training webinar was held for employees of financial departments of Kazakh companies.

On October 11, a seminar called "Stock market fundamentals" was held for owners and executives of companies and employees of the Damu Fund.

On December 20, together with the Institute of Internal Auditors, a roundtable was held on the subject of "The role of internal audit in corporate governance", where representatives of the Institute of Internal Auditors and representatives of the internal audit of large companies talked about innovations, international standards and advantages of this activity.

MORE THAN 200 PARTICIPANTS

attended training events of the Exchange.

PARTICIPATION IN FORUMS, FAIRS AND CONFERENCES

During the year, the Exchange made presentations at five public events – forums, industry exhibitions, themed conferences – in regional centers, in the cities of Almaty and Nur-Sultan. The Exchange's employees spoke on the topic "KASE is a fundraising platform". Among such events are the 18th North Caspian Regional Exhibition "Atyrau Oil and Gas", which took place on April 9 in Atyrau; the 10th Mining and Metallurgy Congress "Astana Mining & Metallurgy" ( June 12, Nur-Sultan); the 15th international exhibition of technologies and equipment for the mining and metallurgical complex "Mining Week Kazakhstan 2019" ( June 25, Karaganda; Central Asian international exhibition "Mining and Metals Central Asia 2019" (September 18, Almaty); International investment forum "Zhetysu Invest 2019", panel session "Effective business tools for investment profitability" (October 4, Taldykorgan).

ISSUER SUPPORT

EVENTS

The Exchange holds the Issuer Day events on its premises to improve communications between market participants, listed companies with investors and other interested parties.

During 2019, four such events were held, whereby institutional investors and shareholders met with the management of companies listed on the Exchange.

On April 19, the Issuer Day for KEGOC took place on the Exchange. The company's management informed shareholders, investors, professional market participants and the media about results of operations in 2018, promising projects planned for implementation and aimed at improving the reliability of the electric power system of the Republic of Kazakhstan.

A meeting of the management of the IFC Treasury Head Office in London and the head of the IFC office in Kazakhstan with investors and professional participants of Kazakhstan's securities market was held as part of the Issuer Day on June 27.

The Issuer Day within the framework of the planned offering of coupon bonds of Housing Construction Savings Bank was held on July 10, where Lyazzat Ibragimova, Chairperson of Management Board of the bank, has met potential investors and professional participants of the securities market. On September 5, a meeting of Bakytzhan Kazhiev, Chairman of KEGOC’s Management Board, with investors and professional participants of the securities market took place in an interactive form. The participants received answers to the most relevant questions of the company's development strategy, increasing the company's profitability and the reliability of investments in KEGOC.

Events

for Investors

TRAINING PROGRAMS

The Exchange conducted free-of-charge educational events for broad public in 2019 in order to expand the investor base and increase the financial literacy of the population.

On May 29, a seminar for local retail investors called "How to trade in the securities market" was held at the Exchange with the support of the Damu Fund. An interactive game "Financial Tasting" was conducted as part of the event.

On October 4, 2019, the trading closing ceremony "Ring the Bell for Financial Literacy" and the closing ceremony of the Competition among retail investors took place at the Exchange within the framework of the event "Investor Day on KASE". The ceremony "Ring the Bell for Financial Literacy" is an initiative of the World Federation of Exchanges under the IOSCO (International Organization of Securities Commissions) global initiative called "World Investor Week", designed to emphasize the importance of improving the financial literacy and making financial services accessible to all groups of the population.

On November 12, a seminar "Stock market fundamentals" was held at the Exchange for teachers and students of Kazakh universities.

On December 5, a seminar for local retail investors "How to trade in the securities market" was organized and held at the Exchange with the support of the Damu Fund. The speakers were employees of the Exchange and brokerage firms. An interactive game "Financial Tasting" was conducted as part of the event.

Seminars on products and services of the Exchange for employees of branches and customers of Kazpost were held in seven regions of Kazakhstan

- Aktobe region, September 25;

- East Kazakhstan region, October 21;

- Kostanay region, October 25;

- Pavlodar region, November 5;

- Akmola region, November 15;

- West Kazakhstan region, November 19;

- Mangystau region, November 26.

To form practical experience and increase the financial literacy of the student community and other retail investors, the Exchange annually holds two competitions: the Exchange Simulator and the Retail Investors Competition.

The competition among retail investors in the stock market was conducted from September 1 to October 1, 2019. A total of 454 retail investors who are clients of brokerage firms that are members of KASE, took part in the competition. During the competition, its participants concluded more than 2,800 transactions in the amount of more than KZT137 mln.

The educational project "Exchange Simulator" is carried out for students of finance and economics and other faculties who want to broaden their professional knowledge in the framework of the curriculum, as well as their practical skills in the stock market. In 2019, training sessions were held from April 1 to April 30. 1,167 students from 46 universities participated in the project. The total volume of transactions reached KZT5,989.9 mln.

EVENTS

FOR MEMBERS OF THE EXCHANGE

During 2019, there were 11 meetings with members of the Exchange. These meetings focused on issues like the introduction of the ASTS+ trading and clearing system and the services of the Central Counterparty, as well as issues related to the development of exchange markets and programs for market- makers on equity and debt securities on the stock market.

In particular, the conditions of announcement and maintenance of quotations for government securities were changed. As a result, new market-maker for the mentioned types of securities represented by Halyk Savings Bank of Kazakhstan, appeared in the stock market.

With the transition to the ASTS+, an additional scheme of announcing and maintaining quotations was developed for market-makers, which provides incentive measures such as payment of remuneration to market-makers.

Under the technical support of the Asian Development Bank for the project on improving public debt management, a roundtable was held on October 25, 2019 on the topic "Development prospects for local government securities market" with the participation of ADB experts and professional participants of the stock market.

KASE AS AN INFORMATION

PLATFORM FOR PROMOTING

THE NATIONAL MARKET

Proactive work continued in 2019, to maintain the image of the Exchange as an esteemed and transparent organization. One of the important aspects of building the KASE brand remains the interaction with the media. The Exchange's efficiency and professionalism were the basis for the Exchange's mutually beneficial cooperation with the press.

In total, five press conferences and eight media briefings were held in 2019. The Exchange held seminars on handling the financial information for media representatives in the cities of Shymkent, Aktobe, Kostany, Pavlodar, Oral and Aktau. Within the framework of increasing financial literacy and investment culture of the public, as well as promoting Kazakhstan's stock market, nine interviews with KASE management, 32 articles in various mass media with comments of the Exchange's experts were published in the media.

Another channel for promoting information about Kazakhstan's stock market is a series of television programs on the Atameken Business Channel. During the reporting period, Atameken Business Channel released 14 television programs "Stock Market. Status Pro", 106 television programs as part of the daily program "Stay Tuned" and the weekly program "KASE Weekly".

The most common tool for transmitting news about KASE are still press releases. In 2019, 31 press releases were prepared and published.

The information platform KASE Talks is gaining popularity. It is a series of public lectures with the participation of well-known financiers of the country, which the Exchange launched in 2018 to popularize the financial market. During the period under review, eight open lectures KASE Talks were held. About 500 listeners on average – students, teachers, independent experts, and journalists visit KASE Talks annually.

Under the Exchange's development strategy for 2019-2021 on IT modernization of KASE's trading and clearing systems, as well as the promotion of new instruments and services, an event called "Professional networking of employees of the trading and treasury divisions of members of the Exchange" was conducted.

In addition, the Exchange co-organized two panel discussions – as part of the Astana Economic Forum and the conference “Financial Market and the Real Sector of Kazakhstan's Economy" in 2019.

ANALYTICAL PRODUCTS

In 2019, a new direction was fostered – analytical products, which are regular reviews of the market situation, trading structure, key events in the business of listed companies. KASE Weekly newsletter, information bulletin, sectoral reports are freely available on the Exchange's website.

From January 4, the Exchange's website features a new section called "Disclosure of information by companies". The purpose of this product is to promptly notify market participants of incoming documents and messages from issuers and initiators of securities admission as part of fulfillment of their information disclosure obligations established by the Listing Rules. An online feed for links to newly published documents is available on the main page of the website.

PROMOTION

OF MARKET DATA

In 2019, the analytical company S&P Dow Jones Indices signed up to KASE's information services. As a result, the number of companies using exchange information in their operations amounted to 26. In addition to mentioned companies, KASE data is received by clients of thirteen vendors of KASE, which include world news agencies Bloomberg and Refinitiv. The number of those subscribed to viewing the trades in real time through the Exchange's website as of January 1, 2020 amounted to 156. KASE has been continuously modernizing its technical infrastructure in order to improve the quality of the service of providing exchange information, and has also been working on the creation of new information products and services. In particular, in 2019, the information bot @KASEInfoBot in the Telegram, launched in 2017, was supplemented with new features. The bot users, whose number exceeded 4,000, can view information about special trading sessions and their results, official cross-rates of the National Bank of the Republic of Kazakhstan in addition to real-time trading information and can use the notification function when the certain price of an instrument is reached.

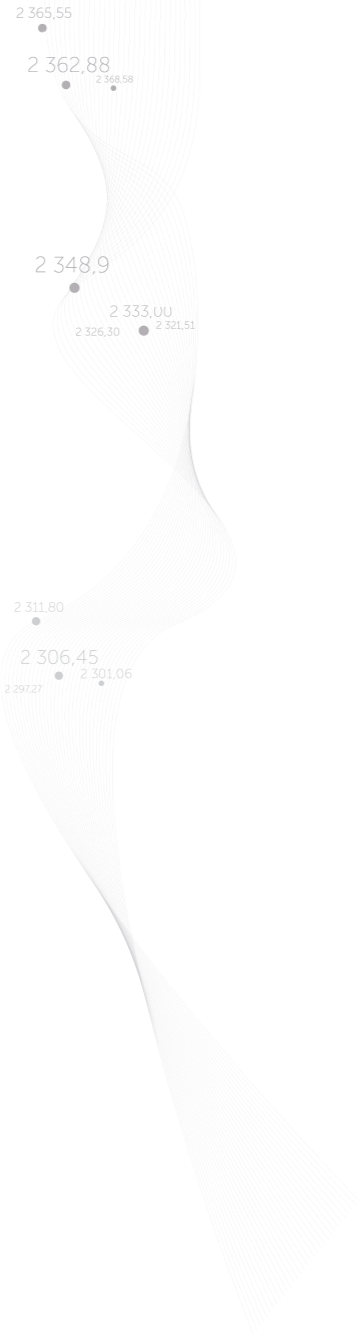

BUILDING THE YIELD CURVE. NEW METHODOLOGY

The government debt's yield curve is a benchmark and the main landmark for the cost of borrowed capital for all companies issuing debt securities, as well as for debt market investors. A liquid government securities market is needed to build a curve and ensure its representativeness. For several years, the Ministry of Finance and the National Bank have been making efforts to ensure liquidity in this market segment. After the National Bank switched to the inflation targeting regime, a stabilization of interest rates was observed in the market, which eliminated the most acute problems in the pricing of the debt market and reduced the discrepancy in bid and ask prices. In addition, the National Bank began to regularly offer notes to withdraw excess liquidity as part of its interest rate management policy. This allowed increasing the liquidity of up to one year. Market participants formed expectations on this horizon, and the yield curve on the segment of up to one year reflected expectations that were as close as possible to the market. However, for periods of more than one year, iquidity in the secondary market remained low. Accordingly, the methodology for building the GS yield curve required improvement.

KASE together with the National Bank conducted research and determined the Nelson-Siegel mathematical model as the most suitable for building the GS yield curve. A curve building methodology was developed that was implemented in the information system "IRIS" of the Exchange. After carrying out trial retrospective calculations of the GS yield curve and optimizing the program code for its building, the Exchange announced the start of building the GS yield curve based on the new methodology, as well as using the updated curve data for market valuation of securities traded on KASE

From September 30, 2019, the daily calculation of data according to the new methodology began and during the month KASE amortized the values of market prices from the previous methodology to the new one. Such amortization was carried out in order to avoid sharp fluctuations in market prices and to exert pressure on the value of collateral in the repo market.

The new methodology was developed using generally accepted mathematical apparatus. The methodology shows a stable result at times of low liquidity and maximally reflects current market conditions. When building a curve, the degree of influence of parameters of each transaction included in the calculation depends on its volume and recentness. To eliminate abnormal price values, the methods of statistical processing adopted in the world are used.

From November 4, KASE began releasing on its website the calculated parameters used to build the yield curve, which allow any market participant to independently reconstruct the curve.

IMPROVING THE SERVICE QUALITY

One of the most important goals of the Exchange is to increase the level of satisfaction of its customers, to maintain high positions in the evaluation of exchange services and to find new ways to improve them. Assessment of the quality of exchange services is carried out on the basis of the Methodology for assessing the level of customers' satisfaction with the activities of the Exchange, which provides for an annual questionnaire on the main business processes. To asse ss the level of satisfaction, open and closed questions are used with the answer options provided. Over the past two years, the Methodology has been supplemented by the requirements for self-assessment, and a section on information services, as well as changes have been made to the content of the questionnaire, which was divided into classes of consumers of the services: members of the Exchange, listed companies and users of information services of the Exchange.

29 members of the Exchange out of 52 (55.8%), 96 issuers out of 157 (61.1%) and five customers of the Exchange's information services out of 184 (2.7%) took part in the survey of 2019 results. The latter were not included in the calculation of the overall assessment due to the insignificant participation share. The overall rating of the Exchange's customers satisfaction based on 2019 results was 93.3%, which is 3.8% higher than in 2018.

Based on results of the survey, a set of measures to improve the Exchange's services was identified, which were included in the list of main tasks for 2020.

form

Try later...