STRATEGIC DIRECTION 1.

IT MODERNIZATION

TECHNOLOGIES. REVIEW OF IMPLEMENTED TASKS

KASE on an ongoing basis works to improve the reliability of its infrastructure, reduce operational risks, develop new trading modes and instruments, implement certified protocols for the exchange of market data.

- - February – a matrix of access to the Exchange's Information systems was developed; the application "Exchange Simulator" based on the sTrade solution was launched;

- - February-March – launch of long currency swaps with maturities of up to one year;

- - June – expansion of the functionalityof the official information channel KASE @KASEInfoBot in the Telegram application;

- - July – technical implementation of the continuous session of the foreign exchange market in the NEXT trading system, the Exchange's information systems;

- - July-October – technical implementation of the introduction of an additional session in the NEXT trading system, the Exchange's information systems;

- - July – implementation of the Frankfurt auction's functionality in the NEXT trading system;

- - December – the introduction of the first release of the ASTS+ system for the stock market, which was preceded by several stages of testing together with the Central Securities Depository and market participants;

- - December – the user's personal account has been introduced on the Exchange's website.

INTRODUCTION OF THE NEW TRADING AND CLEARING SYSTEM OF THE STOCK MARKET

KASE improved and installed the new ASTS+ trading and clearing system with the integrated Central Counterparty functionality during the reporting year.

The ASTS+ system was developed on the basis of the MOEX's TCS as part of the implementation of the Strategic Partnership Agreement with the Moscow Exchange. One of the key advantages of the ASTS+ system is the ability to work with counterparties with different levels of credit risk.

The ASTS+ system has high reliability – its availability level is 99.99%, speed – the processing speed is about 30 thousand transactions per second, and functionality – it supports wide range of trading methods and rules for a wide variety of financial market instruments.

The ASTS+ system provides the broker's clients with the opportunity to submit orders directly to the trading system through SMA access (sponsored market access). For the exchange of data between the exchange trading participants in real time, the FIX-protocol for data transfer is used, which is an international standard. This FAST protocol based exchange information provision service helps improve electronic exchange of financial information, in particular, the dissemination of large volumes of data with minimum delay.

Additionally, the ASTS+ system is provided with robust protective measures, including software-based, technological, organizational, as well as physical protection measures.

The work on customizing the ASTS+ for Kazakhstan's stock market and the refinement of its functionality was finished in the fourth quarter of the reporting year. After a comprehensive testing by specialists and members of the Exchange, the first release of the system was commissioned on December 3, 2019.

- - shares, securities of investment funds and ETFs with settlements in tenge;

- - Eurobonds and depositary receipts with settlements in US dollars.

Internal documents governing the rules, terms and conditions of trading in the ASTS+ trading and clearing system were put into effect.

In addition, during the reporting year, an upgrade of the server and telecommunications equipment for our own IT systems and the MOEX system was completed.

Upgrading the trading and clearing system is an important step in KASE's operation and requires well-coordinated work not only of the Exchange's divisions, but also active involvement of all organizations that use this system and are participants of the trading, clearing and settlement processes, including members of the Exchange, the Central Securities Depository, and the National Bank of the Republic of Kazakhstan as a the regulator and a trading participant. During the work on customizing and implementation of the ASTS+, the Exchange cooperated closely with the above-mentioned organizations. Throughout the year, introductory presentations, meetings and working discussions were held on aspects of operation and capabilities of the ASTS+.

The aim of the Exchange was to provide comprehensive information about the ASTS+ to all interested parties and to ensure their active participation in the testing of the system and preparing it for commissioning. After introducing the first release of the ASTS+ in the stock market, KASE began preparing itself for the introduction of the second release of the system, by means of which all stock market instruments not included in the first release will be transferred to trading in the ASTS+. The launch of the second ASTS+ release is scheduled for the first half of 2020.

NEW INFORMATION

EXCHANGE PROTOCOLS

Due to the transfer of trading of certain types of securities to the ASTS+ system, the Exchange switched to a new protocol of real-time exchange of data between exchange trading participants – the FAST protocol (FIX Adapted for STreaming). The syntax of this protocol is based on the FIX message format, which helps to optimize the electronic exchange of financial information and ensures the dissemination of large amounts of data with minimum delay.

The speed, which is a special advantage of the FAST protocol, allows it to be used in high-speed trading systems that require low transmission delays.

CALCULATION OF INDICES

AND INDICATORS

In connection with the launch of trading in currency swap transactions with maturities from one week to one year, a Methodology for determining indicative GG-spread indicators was developed to assess the estimated prices of swap transactions, which was put into effect on January 28. The Methodology establishes the procedure for determining GG-spread indicative indicators as the values necessary for calculating and determining risk parameters of financial instruments of the foreign exchange market, according to which KASE carries out clearing activities in accordance with its internal documents. In accordance with the Methodology, the indicative GG-spread indicators are calculated as the difference between the values of the yield of government securities of the Republic of Kazakhstan and the yield of US treasury bonds with the same maturity.

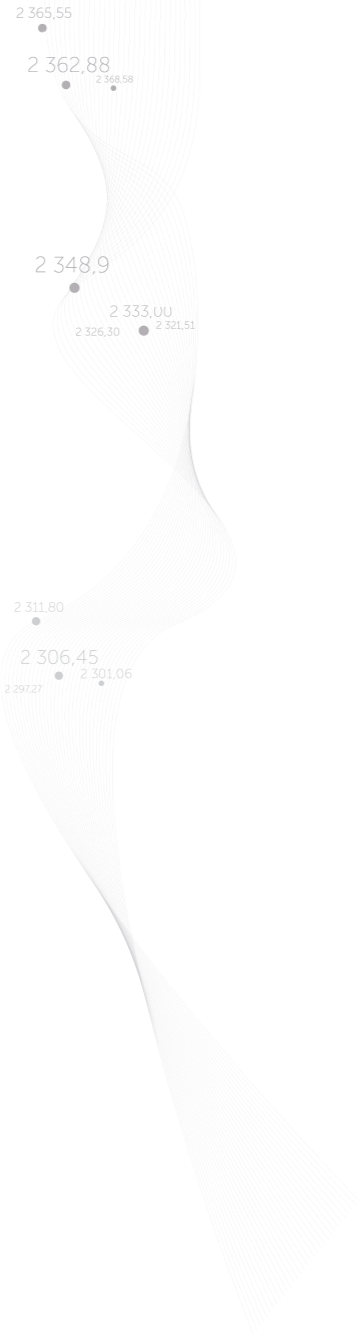

As part of the implementation of the ASTS+ trading and clearing system, which incorporates the Index server, KASE took necessary measures to transfer part of the indicators to the calculation on the new server, in particular, the methodology of KASE Index calculation was adapted to such calculation. Since the mathematical substance of this indicator did not change after adapting to the Index server, KASE continued the number series of the index after the date of transfer of its calculation to the new server.

form

Try later...